Madison Square Portfolio

119 West 24th Street | 146, 206 SF

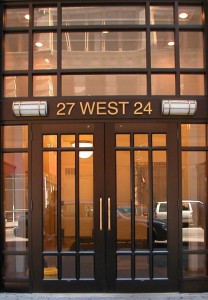

19 West 24th Street | 63,015 SF

15 West 27th Street | 65,578 SF

45 West 27th Street | 66,797 SF

Part of the former FM Ring portfolio, these four buildings were acquired by Kaufman Organization in partnership with Principal Real Estate Investors through a highly structured 99-year ground lease. The buildings had not been occupied for more than a decade and were in significant disrepair at the time of the transaction. Kaufman commenced a $30M major capital improvement program that included renovated lobbies, new retail storefronts, modernized elevators, and the installation of tech amenities and telecommunication risers, a comprehensive program that will turn each of the buildings from an eyesore into a fully modernized, pride -of -ownership, prime office property, and a market leader in each of its respective submarkets.